When Mr V (husband) and myself planned our lives together in our 20s we took a decision to focus more energies on our family and family businesses and less on top careers. We had decided on shorter career lives. This was before the ‘fire movement’ came to be. For those who do not know, ‘FIRE’ is an acronym for ‘Financial Independence Retire Early. We never imagined that this decision would be the one thing that gives us purpose and a strong joint passion. Financial independence and early retirement were the goal. I have been outside formal employment for almost 5 years now. I also took my semi-retirement break at 35.

The past few years were super challenging. We lost my mother in December 2020. The pain that I went and am still going through cannot be articulated. My mother was a close friend. The year 2020 was the most difficult year globally. I have not blogged in both 2020 and 2021. However, in 2021 I went back to tracking my finances. This was a needed distraction.

Back in January 2020, our family’s financial plan was to double our net worth and income in two years without acquiring new physical assets. Then 2020 turned to be the weirdest period of our lives. I rested more that year. The plan to double our net worth was only implemented in mid-2021. My excel spreadsheets and graphs are beautiful to watch every quarter.

Whilst excel is great, I miss keeping myself accountable through blogging. I will use this platform to keep track of the progress in our ‘project July 2021- June 2023’. It will take a lot of doing to achieve this goal but it is doable. The detailed plan for 2022 will follow in the next blog post.

2021 Highlights:

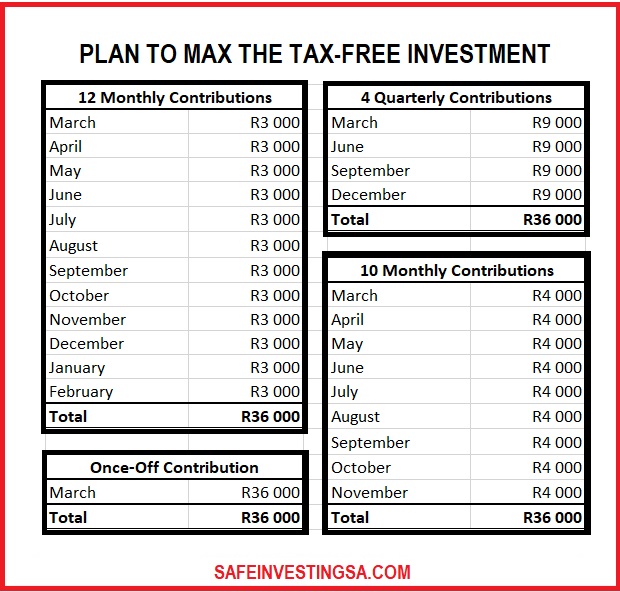

1.Stocks. What we have done from July 2021 is increase our investments in stocks. We did get lucky with the SASOL dip and the great performance of the US dollar stocks in the past year. The year or semester rather, was great. We did not forget our tax free benefit accounts which are also in Exchange Traded Funds (ETFs).

2. Rental Income. We also had major renovation projects to increase the rental income. One renovation project was in our multifamily let. We renovated the biggest unit. This property has 6 lease contracts in it. We are finalising this remodel project soon. The renovation should increase the income of the unit by 60%. The plan was to further develop this property. The city’s 2018 Regional Spatial Development Framework (RSDF) removed the erf from the area that they earmarked for densification. So, we could not.

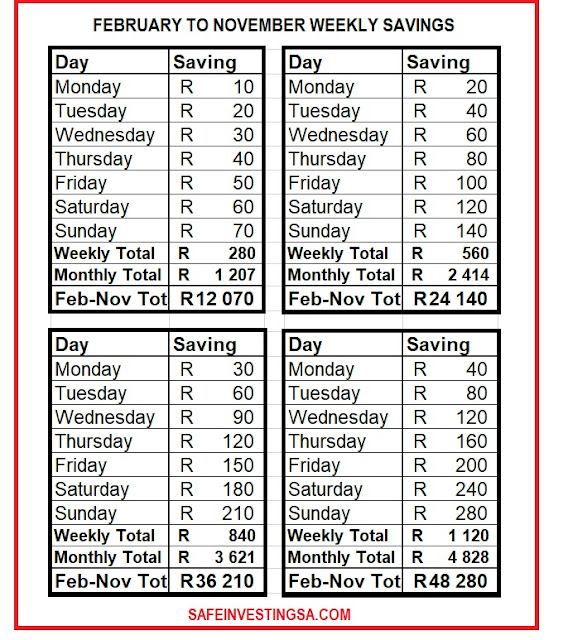

3.Retirement and savings. We also contribute to our retirement accounts monthly. We each have two accounts with one being a retirement annuity. The performance is not stunning, but they are a great addition. We also keep some small figure in savings to serve as an emergency fund. We no longer have a big sum in the emergency funds accounts. Interest rates are too low for that. My zero-fee credit card is my emergency account. I never pay interest on a credit card.

4. Gigs. I achieved more in 2021 than I did in the past few years. My freelance income has been channelled to fast-track Mr V’s retirement. This deserves a separate post.

5. Content creation. My content creation income was very small. Like I mentioned, I went AWOL. See next blog post for the plans for 2022 on this.

6. Speaking. I was a visiting lecturer and had a few speaking appearances last year. Noteworthy is my appearance as an expert at an ‘Africa Trade Conference 2021’ and the full week radio show talks.

7. Wealth transfer. The Geek (our son) turned 18 in 2021 and started on the investment journey of his own. The boy has done very well and invests in the US stocks and ETFs exclusively. He has impressed us by his focus on managing his finances. We have discussed building a good credit rating record and getting his first credit card. We are also helping him max his tax-free savings account.

8. Budgeting. I still work with a budget that is in my head. Budgeting never works for me. I make my targets, save, invest and then spend. Paying myself first helps with my impulsive habits.

9. Debt. On debt, we still only have investment property debt. We also have reduced this remarkably in 2021. We are generally not bothered by rental property mortgages. Our priority is having no debt in our primary home and no debt anywhere else. This has always been the case.

10. Travel. I had plans to travel in 2021. Ireland and Egypt were on the list. Due to the pandemic I only managed to travel between Angola and South Africa. I am looking forward to open borders. The family’s feet itch.

11. Comfort. Our primary home was the most costly project for the year. We are a family that believes in comfortable living, and always prioritise comfort and healthy food. OH, we sure love our food. We did get approached by interested prospective corporate tenants to lease this property. I was welcoming the idea of great income, but Mr V and the Geek refused to let go.

12. Finally, 2021 had its challenges. We had a few months of vacancies and unpaid rentals due to the pandemic. This is not common as we invest mainly in the heart of national government and diplomat presence. Our 2022 goals will highlight how this discomfort pushed us to grow. Our investment city is also growing and is now with a population of over 2.5 Million.

Thank you for visiting Safe Investing SA. For daily motivation like us on Facebook, Twitter and/ or Instagram.

--------------------------

Author Mbini Kutta, a businesswoman, personal finance author and investor.