What is a Tax Free Savings Account and Investment (TFSA)?

Since 2015, SA government decided to gift us with an amazing tax-free product. Contributions to a TFSA are not deductible for income tax purposes. Contributions and income (income tax, dividends tax or capital gains tax) earned in the TFSA are tax-free.

Here's the catch: this is a long-term savings benefit limited to R500,000 contribution in one's lifetime and R36,000 in one year. Withdrawing from this account should be avoided.

Annual Limit

The Annual limits have been steadily increased from R30,000 in 2016, R33,000 in 2018 and R36,000 in 2021. Maxing the contribution to the Tax Free Savings Account and Investment is ideal. That and not withdrawing, I emphasise. Unused annual limits are forfeited. Important to note is that there is a tax penalty for amounts that are above the annual limit. The tax penalty is 40% on the excess contributions above the annual limit.

|

| Tax Free Savings Account and Investment |

Who is Eligible for a TFSA?

South Africa allows all South Africans to invest in a Tax-Free Savings Account or investment. This includes children. Parents can invest on behalf of minor children.

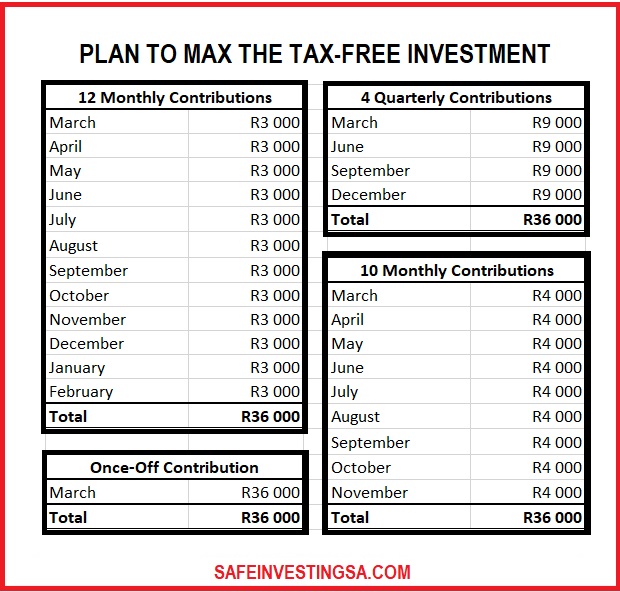

Maxing out the TFSA should be a priority. The examples in the image above are an indication of how a TFSA can be maxed out every year.

- Once-Off Investment. One can invest the full annual limit in one payment. March is the first month of the financial period. However, one can invest at any time during the financial year.

- 12 Months Instalments. One can also spread their deposits in 12 equal instalments. This can be automated from your main bank account to the investment tool used for this purpose.

- Quarterly Deposits. The quarterly deposits work the same way as any instalment deposits. Any form of instalment works. The amounts deposited do not need to be equal.

The reason March is used as ideal in the example is that, the investment gets a growth benefit for the entire financial period. In a 11.5% return per annum for instance, R36,000 would have grown to above R40,000 at the end of the financial period.

The following accounts qualify to be used as Tax Free Savings Account and Investment:

- Fixed deposits

- Unit trusts

- Retail savings bonds

- Some endowment policies issued by long-term insurers

- Linked investment products

- Exchange traded funds (ETFs).

One can transfer between tax free savings accounts or investments as they change the investment vehicles or service providers. Service providers are responsible to provide SARS with all the information required for tax filing.

Are you investing in a TFSA? Please share the article.

Thank you for visiting Safe Investing SA. For daily motivation like us on Facebook, Twitter and/ or Instagram.

--------------------------

Author Mbini Kutta, a businesswoman, personal finance author and investor.