Back in July I mentioned my plan to set a car fund here. I was to choose between that and buying a car through the traditional high interest car loan. The thought has never left my head since. The most tricky part was on the choice of saving/ investment tool. It was either the money market, similar to the Just Invest account that I use for the emergency fund, or stocks through an index fund.

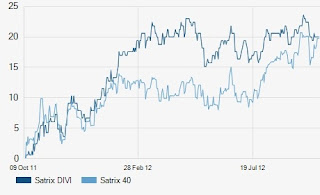

I then went ahead to compare the Mr's index funds using the spreadsheet (I love excel). Remember how I go on and on about the Dividends as a great form of passive income. So Satrix DIVI was an obvious winner. It has done well in the past year. Its done well both on capital growth and dividend pay out compared to Satrix 40. That's all I compared.

See the comparison above. Its not as dramatic in a 3 year graph. But, like I mentioned, the high dividend payout is my main motivation. I will stick with the DIVI for the car fund. Its the R5000 per month until I cant take the car shopping abstinence anymore. I hope I can hold on for 5 years. If I don't, its no big deal, I guess. Just saying.

Lets now take a closer look at the share basket in this index fund:

Financials 38.7%

Industrials 18.27%

Telecoms 12.67%

Materials 9.67%

Consumer Services 15.67%

And Others

Whats not to like. I went ahead to check the individual shares in those categories. I liked them. And the 20% growth for the past year also helps. I will report on this monthly as well. Hope its a fun and profitable 5 year ride. Browse the individual shares in the basket below.

Share Basket Constituents for Satrix DIVI - October 2012

I then went ahead to compare the Mr's index funds using the spreadsheet (I love excel). Remember how I go on and on about the Dividends as a great form of passive income. So Satrix DIVI was an obvious winner. It has done well in the past year. Its done well both on capital growth and dividend pay out compared to Satrix 40. That's all I compared.

|

| Setting a car fund using Satrix DIVI |

See the comparison above. Its not as dramatic in a 3 year graph. But, like I mentioned, the high dividend payout is my main motivation. I will stick with the DIVI for the car fund. Its the R5000 per month until I cant take the car shopping abstinence anymore. I hope I can hold on for 5 years. If I don't, its no big deal, I guess. Just saying.

Lets now take a closer look at the share basket in this index fund:

Financials 38.7%

Industrials 18.27%

Telecoms 12.67%

Materials 9.67%

Consumer Services 15.67%

And Others

Whats not to like. I went ahead to check the individual shares in those categories. I liked them. And the 20% growth for the past year also helps. I will report on this monthly as well. Hope its a fun and profitable 5 year ride. Browse the individual shares in the basket below.

Share Basket Constituents for Satrix DIVI - October 2012

Share Name

|

Industry

|

Weight

|

ABSA Group

Ltd

|

Financials

|

3.67%

|

African Bank

Inv Ltd

|

Financials

|

3.52%

|

Allied Elec

Corp Pref

|

Industrials

|

3.38%

|

Allied

Technologies Ltd

|

Telecommunications

|

4.95%

|

AVI Ltd

|

Consumer

goods

|

2.36%

|

Coronation

Fund Mngrs Ld

|

Financials

|

4.47%

|

Exxaro

Resources Ltd

|

Basic

Materials

|

2.61%

|

Firstrand Ltd

|

Financials

|

2.57%

|

Investec Ltd

|

Financials

|

3.16%

|

Investec plc

|

Financials

|

2.96%

|

JD Group Ltd

|

Consumer

services

|

3.61%

|

JSE Ltd

|

Financials

|

2.51%

|

Kumba Iron

Ore Ltd

|

Basic

Materials

|

4.71%

|

Lewis Group

Ltd

|

Consumer

services

|

4.46%

|

Liberty

Holdings Ltd

|

Financials

|

3.58%

|

MMI Holdings

Limited

|

Financials

|

3.67%

|

Mondi Ltd

|

Basic

Materials

|

2.33%

|

MTN Group Ltd

|

Telecommunications

|

3.48%

|

Nampak Ltd

|

Industrials

|

3.44%

|

Nedbank Group

Ltd

|

Financials

|

2.88%

|

PPC Limited

|

Industrials

|

3.24%

|

Remgro Ltd

|

Industrials

|

4.54%

|

Reunert Ltd

|

Industrials

|

3.64%

|

Sanlam

Limited

|

Financials

|

2.70%

|

Sasol Limited

|

Oil and Gas

|

2.81%

|

Standard Bank

Group Ltd

|

Financials

|

3.02%

|

The Foschini

Group Limit

|

Consumer

services

|

2.85%

|

The Spar

Group Ltd

|

Consumer

services

|

2.19%

|

Vodacom Group

Ltd

|

Telecommunications

|

4.16%

|

Woolworths

Holdings Ltd

|

Consumer

services

|

2.52%

|