This blog is by design meant to inspire people to learn simple ways of building wealth. Over the years, followers email to get simple strategies to start paying debt, saving and investing. Every year we have a savings culture revival. This year we are starting our daily savings challenge in February until November.

|

| daily savings challenge |

We are adopting a programme that is similar to a stokvel model. I notice that people are more motivated to save when they are in companies of like-minded individuals or with automated bank transfers. If you are a loner like myself, adapt this daily savings schedule to your needs. These can be used for monthly, weekly or daily savings.

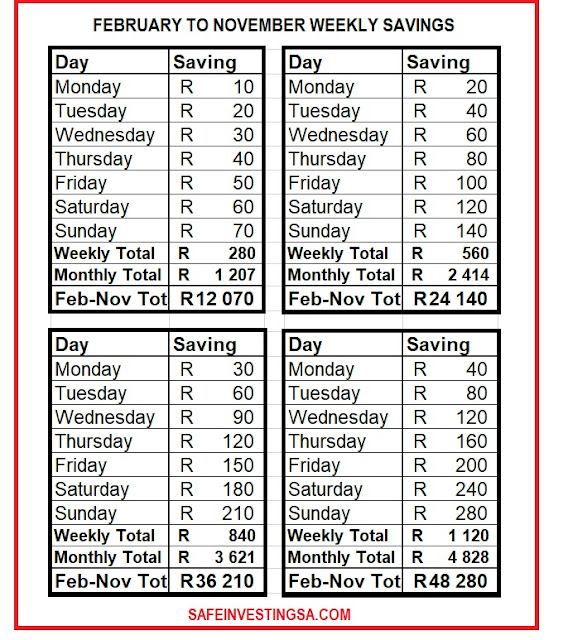

In the first table we are saving R10 on Mondays, R20 on Tuesdays, etc, and a total of R12,070 in the 10 month’s period from 1 February to 30 November. The last table enables one to save a total of R48,280. These totals are own contribution before growth in interest and returns.

How this Daily Savings Challenge Works:

1. Choose a plan that you are comfortable with from the image above.

2. Decide on the saving frequency. It could be a low amount daily, a weekly amount or a bigger monthly savings amount.

3. Open a savings account linked to your main bank account to easily transfer the amount you have decided on as often as you choose. An interest-bearing account would be ideal for an emergency fund. Some use the Exchange Traded Funds for longer term investments. A savings pocket is usually an interest-bearing account that requires no minimum deposit. However, pay attention to the interest structure. A money market account could have higher returns. If the savings are for a specific cause/ timeframe, a notice account could be the best tool. The ETFs generally have higher returns and are best suited to longer term investments.

Be reminded that the totals in the image above are own capital only without interest or returns. Some of our readers are saving towards their:

• Emergency fund.

• Children school fees for the following year.

• Deposit on a home.

• Future renovations.

• A wedding.

• Deposit on a car.

• Investment for retirement.

• Investment for passive income like dividends.

• Business capital.

• Once off event.

Remember, depending on each one's needs, one can save in a notice account, money market account or invest in exchange traded funds (ETFs) for better returns. For those who prefer a higher amount, we will add a few more options. For now, choose from one of our daily savings challenge plans above.

Thank you for visiting Safe Investing SA. For daily motivation like us on Facebook, Twitter and/ or Instagram.

--------------------------

Author Mbini Kutta, a businesswoman, personal finance author and investor.

Please add me on wats app 0658793005.im interested in investing please be my guide.

ReplyDelete